Home List your patent My account Help Support us

Novel Cancer therapy using micro-robots

[Category : - HEALTH- DESIGN PATENTS- PET PRODUCTS]

[Viewed 1906 times]

Elbe Valley medical believes that its technology can change all of this while reducing the burden of national health-care systems globally. Money which is currently being spent on cancer care can be released for other purposes such as upgrading infrastructure and new schools because of reduced costs of Elbe Valley Medical greatly reduced treatment costs.

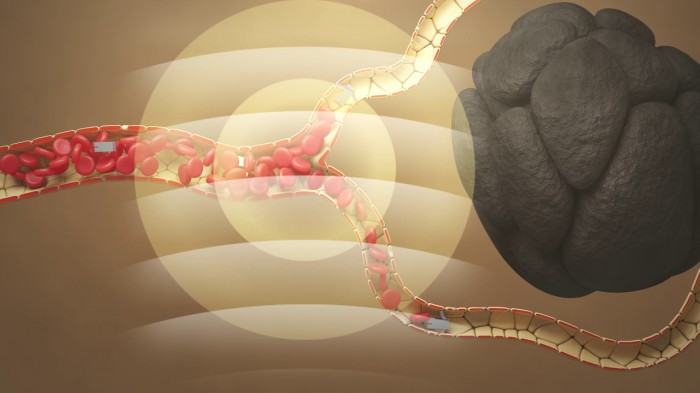

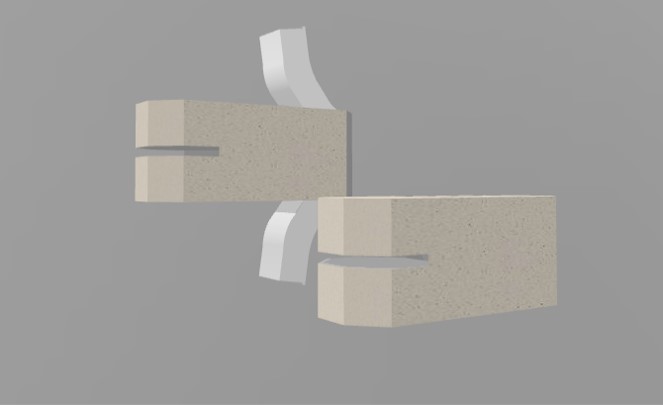

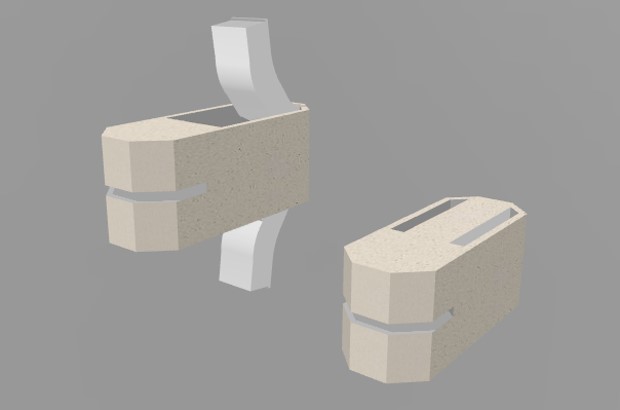

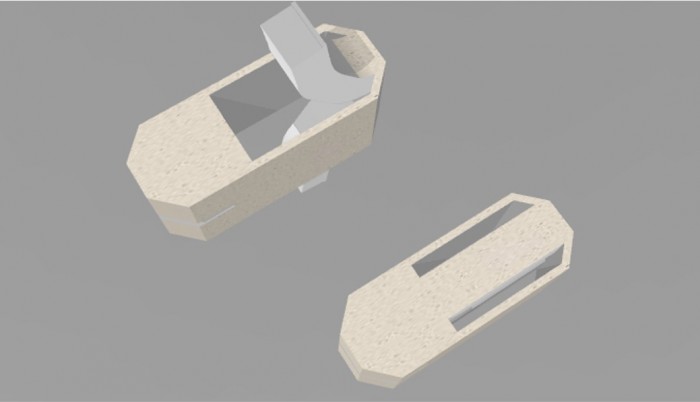

Our solution is based on the premise that a tumour starved of blood supply will die. It is a proprietary blood-borne nanorobot system. Using our system, a patient will be injected with over a billion of our tiny devices. These devices will travel all around the body via the bloodstream and when activated, they will stop blood flow at the blood capillary level thus choking the tumour in the target area in mere minutes. Our system is more suitable for large and aggressive tumours. In fact the more severe cancers are easier to treat than smaller tumours. While we are currently focused on beating cancer, our technology has many applications outside the field of Oncology.

Global Oncology Pharmaceutical Costs

Global costs of oncology therapeutics and supportive care drugs increased from $91Bn in 2012 to $113Bn in 2016, to $160 Bn in 2019 and a projected $255 billion in 2024 with the United States accounting for 46% of the total global costs.

Total Impact

The increase in global costs for oncology and supportive care medicines is related to an increase in the number of approved therapies and corresponding higher costs of novel agents. In 2010, taking into consideration the direct costs related to the prevention and treatment of the disease and the economic value of lives lost and disability caused, cancer cost the world approximately $1.16 trillion. Further estimates, which add the longer-term costs to patients and their families, bring the annual cost of cancer to S2.5trillion.

Elbe Valley Technology

The Elbe Valley Solution is based on the premise that a tumor starved of blood supply will die. Using a proprietary blood-borne nanorobot system, a patient is injected with over a billion of specially designed nanorobots. They travel all throughout the body via the bloodstream and when activated through the patented precise electromagnetic location system before or at a tumor, deprive it of its blood flow and life breathing oxygen. Tumors are reduced and can be eliminated and/or destroyed.

Nanotechnology History

Anticancer agents continue to be a preferred therapeutic option for several malignancies. Despite their effectiveness, oncologists are continually looking for tumor-specific anticancer agents to prevent adverse effects in patients. Targeting of imaging agents to cancerous tissue is another area that is enthusiastically explored to circumvent some of the drawbacks that current imaging agents possess, including the inability to target small tumor cells, inadequate imaging period, and the risk of renal damage. Formulation scientists have explored nanotechnology-based delivery systems for targeting anticancer agents and tumor-imaging agents to cancer tissue. Targeting with nanotechnology-based delivery systems has been investigated by both passive and active mechanisms with significant clinical success. This review presents a discussion on targeting strategies used for the delivery of nanoparticles by passive and active mechanisms, focusing more specifically on active targeting of nanoparticles using albumin, folic acid, transferrin, and aptamers as targeting ligands.

It has been just over two decades since the first nanoparticle-based therapy was FDA approved for the treatment of cancer.

Financial information

We are looking to sell this patent as we wish to focus on other areas. This invention has not been licensed yet to any other parties.

The following compilation represents five emerging biotechnology companies with valuations ranging from 4.5 to 140 times market value depending upon maturity at acquisition.

The following Start Up Oncology Business have been purchased by leading

Pharmaceutical Companies based upon technology and industry indicators.

LOXO Oncology purchased by Eli Lily for 8 billion

Their own funding rounds Series A and B totalled 57 million, in 2013 and 2014.

2019 sales $200 million

Projected sales for 2023 1.14 Billion

One drug- Vitrakvi

2.

FLEXUS Acquired by Bristol Myers Squibb for 1.25 Billion after 17 months

After raising 20 million and 18 million from three sources and with no drug in clinical trials. FLEXUS sold its IDO TDO discovery program to Bristol Myers.

3.

FLAT IRON HEALTH -software company founded in 2012 sold in 2018 for 1.9 Billion to Roche. Acquisition announced February 2018.

FLAT IRON's software is Cloud based and serves to accelerate cancer research

and improve treatment options for cancer patients. Company was founded based

on personal need of one of its founders.

FLAT IRON had three rounds of funding A, B and C with a total of 21 investors

and 313 million dollars. The funding rounds occurred between 2013 and 2016.

4.

IGNYTA was founded 8 / 29 / 11 and later acquired for 1.7 Billion by Roche in 2018.

IGNYTA specializes in personalized medicine for auto immune diseases. Their immuno Oncology drug Entrectinib was in Phase I trials when they were approached about an acquisition. They were acquired.

They had nine rounds of funding for a total of 375 million from 2013 to 2016.

Their current annual revenue is 150,000.

5.

TESARO was founded in Waltham, Massachusetts in 2010.

Their biotechnology seeks to improve the lives of cancer patients. They were just

beginning clinical trials on Jejula for Ovarian Cancer in 2016, which is a PARP

inhibitor., when acquisition talks surfaced.

Over a seven-year period, they raised 457 million dollars

They were acquired in 2018 for 5.1 Billion by GlaxoSmithKline

Their current revenue is 166 million with three drugs in development.

Asking price:

Make an offer

Make an offer

[ Home | List a patent | Manage your account | F.A.Q.|Terms of use | Contact us]

Copyright PatentAuction.com 2004-2017

Page created at 2026-01-07 17:38:57, Patent Auction Time.

Patent publications:

Patent publications: US 11026692

US 11026692 Great invention

Great invention